Decision #3.1 - Shared Finances Update

The following is a letter I sent to the collective parish Finance Councils, in preparation for a March 6, 2025 meeting. I am posting this in late May 2025, so these numbers are already seriously out-of-date. Nevertheless, it is important to share this analysis, as it provides context for decisions that will go into effect soon.

March 01, 2025

Whatcom County Finance Councils,

Short Version: I need your advice on how to rebalance regional finances to prevent a major shortfall at Assumption.

FY24 as a Standard

The purpose of Partners in the Gospel is to improve on the status quo, so we should eventually expect our finances to change, possibly significantly. However, my desire is that the major fiscal change in FY25 should be to our structure, not our bank accounts, and my metric for a good first year structure is that it is not a significant deviation from the FY24 status quo. When major changes do occur, I want them to be deliberate, not the accident of a regional structure. To that end, this was our financial picture at the end of FY24:

Remember that “Operating Surplus/Deficit” removes one-time gifts and one-time (usually capitalized) expenses. These numbers represent inherent financial structure that we should expect to recur from year to year if expenses and income remain stable.

FY25 Numbers through Q2

These are our FY25 numbers through Q2, which have been solidified and checked since many of you saw them in Finance Council. These numbers also represent the regionalization of school support which I promised we would be doing.

*Collection income is not directly analogous to Ordinary Income (which includes things like program fees and business income), so it is not exactly fair to compare the FY24 and FY25 percentages. However, the Δ is shown to note that relative positions have not changed significantly post-Partners.

If we compare the percentage of County Collection (FY25) to percentage of County OI (FY24), we can see that the values are roughly the same. Sacred Heart, Deming, and Ferndale have seen an increase in giving relative to other locations, while Assumption, Lynden, and Lummi have seen a decrease. These minor changes cannot account for the major swings in surplus/deficit between locations, however, so we have to attribute that to the regional assessment system.

Theoretical FY25

If my goal is to maintain the status quo, let’s see what that should have looked like. I have taken the FY24 surplus/deficit spread ($158,420.57) and recentered it on the doubled FY25Q2 deficit (-$35,622.80), giving us a theoretical $61,398.89 surplus and $97,021.69 deficit.[1] I have also presented two final columns that ignore the FY24 spread, and just distribute the projected county-wide deficit proportionally by OI percentage.

There are, of course, a lot of assumptions embedded in this model, and it does not take into account over/under performance of revenue relative to previous fiscal year. However, those caveats aside, this table suggests that the regional structure has been to the advantage of Sacred Heart, Deming, Ferndale, and Blaine, and the (sometimes extreme) disadvantage of Assumption, Lynden and Lummi.

[1] FY24 Surplus / Deficit: $86,517.47 / ($71,903.10), FY24 Spread: $158,420.57

FY25 Theoretical Surplus / Deficit: $61,398.89 / ($97,021.69) assuming the same spread

Explanation

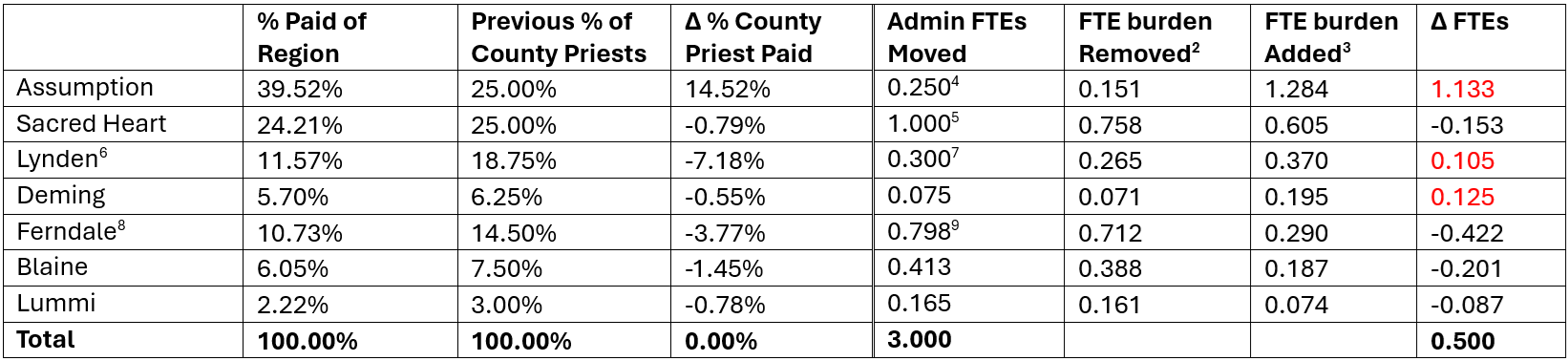

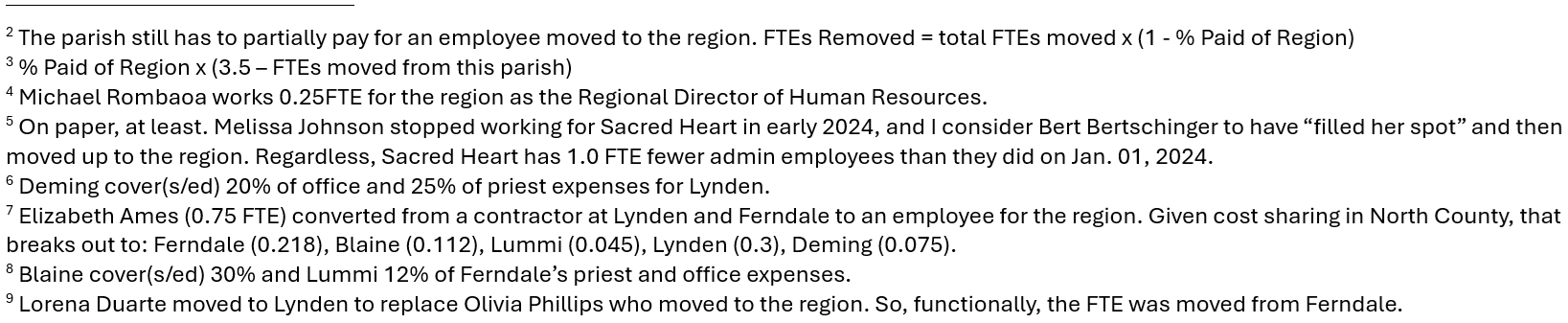

I cannot say exactly why these structural advantages/disadvantages have emerged, but my best, educated guess is that it has to do with relative savings on previous priests and staffing. Think in terms of two groups, priests and PAAs (parish administrators). The regional staffing model can be summarized as moving 4 priests plus 3.0 FTEs of PAAs from local work to regional work. 0.5 FTEs were added, not moved, to the region in the hiring of the Executive Assistant for Clergy. Note that not all FTEs cost the same, so the following table is not perfectly comparing apples to apples.

In addition, some of the decreased year-over-year deficit comes from two staffing moves:

Sacred Heart ended their contract bookkeeper (bumping their Δ FTEs to -0.403)

Ferndale had a 0.5 FTE faith formation employee retire (bumping their Δ FTEs to -0.922)

Proposed Changes / Solutions

I am not necessarily arguing for any of these. These are simply all the potential changes problems/adjustments that came to mind.

#1 - Additional Regional Staff Member

I could really use an additional regional staff member, and the FTE table shows that Assumption has taken on an unfair burden of FTEs in Partners. If I had moved an Assumption employee (let’s assume salary & benefit cost is $90,000 annually) to the region, this is how things would have looked:

#2 - Even out the Priest Costs

Theoretically, if a church like Assumption has 40% of the population of the county it should be receiving 40% of the available priest time. However, that is not how the first year of Partners has gone. The Pastor spends an equal amount of time in every office, and each previous grouping has similar numbers of daily Masses and weekend Masses. To that end, we could pay priest costs at a percentage close to priest presence, either based purely on 25% per church grouping, or by number of Masses. Theoretically, if we went with number of Masses, we could also change Mass locations if we wanted to spread costs differently.[10]

[10] Viking Catholic has a daily Mass and a weekend Mass, but they are not included here. The reason is that Viking Catholic currently pays for 2/3 of all of Fr. Tyler’s salary and benefits (with the assumption that he is spending approximately 4 days a week on campus work and 2 days a week on parish work, mostly Masses and sacraments). This year, while Viking Catholic adjusts its budget to account for the increased cost, the parishes are paying back that 2/3 as a school subsidy. We have not factored this school subsidy cost back into this analysis (and have also left off the Viking Catholic Masses) because the plan is for that subsidy to be phased out over a few years, and we want to make sustainable, long-term decisions with this analysis.

#3 - Double Staff

Some locations have local staff which double the regional staff, namely, bookkeepers and maintenance staff. By hiring these local staff, certain locations take the burden off of regional staff. And yet, usually it is the locations with the highest regional assessments which have these doubled staff, so they are paying the most for the regional staff while using them the least. Instead, we could consider all bookkeepers and maintenance staff as regional employees, making peace with the idea that the larger locations would get more attention. This is what regionalizing our bookkeeping and maintenance staff would have done to our FY25Q2 surplus/deficits:

Unfortunately, this approach does not help Assumption in the way I would hope, because even though Assumption saves some money on its bookkeeper and facilities manager, it also takes on 40% of Sacred Heart’s 0.5 FTE facilities manager and Lynden’s 0.25 FTE facilities manager. The fact these parishes are double paying for facilities still seems unjust, but I cannot find a systematic way to fix it.

#4 - Sub-Regional Percentages

Our regional assessment is calculated by adding up the total income of the county, and determining what percentage of that income comes from each location. That is the percentage of regional expenses that a certain location is responsible for.[11] So if Assumption brings in 40% of total county income, Assumption is responsible for 40% of total county expenses.

A similar system is used on a sub-regional basis. The Northwest Corner sub-region (Ferndale, Blaine, Lummi) has set its sub-regional assessment very close to the income percentages (58%, 30%, 12% assessed, vs. 56.5%, 31.9%, 11.7% actual). This is not true with the Lynden/Deming sub-region (80% and 20% assessed, vs. 67% and 33% actual). There are historical reasons for this percentage, mostly based on Deming’s relative self-sufficiency in faith formation. Nevertheless, if the Finance Councils thought it was important, it is a change we could make. If we moved Blaine, Lummi, and Deming to actual percentages, these would have been the numbers for FY25Q2:

[11] The other way to do this is to add up the total regional expenses and calculate what percentage those are of total county income (maybe 25%). Then, every location provides that percentage of their income to the region. Both methods return the same results.

Conclusion

I need our Finance Councils to weigh in with their opinions on how to right our structural deficits. Any or all of the four above solutions can be implemented, or maybe you have ideas that I am not seeing. Two final notes:

Retroactive vs. Moving Forward – For the “Priests”, “Double Staff”, and “Sub-Regional Percentages” adjustments, these can be done retroactive to July 01, because they rely on an internal assessment/ordering of money, and they simply recognize (via a different system) a reality that has been true all year. The “Additional Regional Staff Member” adjustment cannot be retroactive because it will change the reality from what it had been in the past.

I bring this up because our deficit parishes have been burdened by this faulty structure longer than they should have been, while Elizabeth and I worked to get our heads around a very new and very complicated financial reality. If we can retroactively get our budgets closer to balanced from the beginning, it will ensure that none of our parishes were unduly burdened by the chaos of the first several months of Partners in the Gospel.Regional Mindset – Some of you may be tempted to advocate for whatever solution will provide your home parish with the largest surplus or least deficit, but that will not be a helpful contribution. We quickly need to get into the mindset of being servants of the entire Church in Whatcom County. The structure that we establish now will hopefully serve us well for decades into the future, even after we are canonically combined and all of our money becomes regional. Please think both in terms of fairness and in terms of sustainability.

Thank you for your service,

In Christ Our Lord,

-Fr. Moore

Addendum – Conclusions of March 6th Meeting

I met with the combined parish Finance Councils on March 6, 2025. We collectively decided on two action items:

We would move forward with regionalizing an Assumption staff member.

We would move forward with regionalizing all currently local facilities and finance staff members.

A point was also raised that the FY24 status quo is already significantly determined by taxing policies. If, for example, we think Lynden and Deming’s finances should look a certain way, that is because Lynden and Deming were already governed by a pre-existing taxing relationship. As such, we have to understand that certain values are already baked in to our assumptions. That point was noted.